cross-posted from Shareable

The day we refinanced our first student loan, four debt cooperative members met for coffee and eggs at a greasy spoon at 8 a.m. to prepare the paperwork. Together, we all went to the bank, got the cashier’s check, printed the letter, and put it in the mail, and it was elating.

So elating, in fact, that residents of downtown Seattle looked concerned as four grown adults let out shouts of joy outside a perfectly average post office after doing a seemingly simple task. But the task was anything but simple—and we had done it together.

Like an untold number of ideas throughout human history, the nuts and bolts of what would become Salish Sea Cooperative Finance (SSCoFi)—a cooperative built to address the student debt crisis—were hammered out over nachos and beer.

Over the past decade, SSCoFi has grown from an idea between friends to a fully functional financial cooperative based in Washington state, which collectivizes members’ resources in order to provide debt relief for our community. We refinance the loans of members who have high-interest student loans and provide an avenue for values-aligned investment for members with capital. We’re proud to have put hundreds of thousands of dollars to work while building community and educating about economic justice along the way.

A lending cooperative like ours serves three primary functions:

- To take money out of Wall Street and big banks and reinvest it locally, thereby creating a means of financial empowerment at the local level;

- To keep more money in local communities, allowing us to realign our finances with people and projects committed to supporting a thriving planet full of life rather than with institutions of extraction and exploitation; and

- To participate in catalyzing the cooperative economy as a real alternative to the extractive capitalist economy. We believe that democracy in the workplace and in finance is essential to creating an economy that works for all.

Community cooperative lending has been, and can be, used to tackle many different issues—from student loans to medical debt, prison debt, or even the financing of projects for a green economy. We hope that any community facing a shared financial burden can find our model useful.

Based on the Guide to Cooperative Community Lending, which SSCoFi published in 2022, this How-to will break down some of the main steps involved in building a debt cooperative—from defining the community to setting up governance to dealing with all paperwork to closing that first loan.

How to build a cooperative to tackle student debt in your community

We’ve broken down the basics into five primary considerations. Each section goes into further depth in the guidebook and has a matching appendix with relevant documents and forms we created. We hope you can use this to empower your people to tackle debt in your community.

1. GATHERING

The process of starting a co-op is both iterative and nonlinear. No matter what, it begins with gathering together, getting on the same page, and building relationships. We started by creating a community and determining what we wanted to do together.

Define your community

Who are you organizing with? We began with a loosely held core team of people who self-selected as being passionate about this project because they had deep, personal experience and trauma related to debt or finance. Our community could be described as including members of the following broad groups:

- People living in the Salish Sea—from Seattle to Whidbey Island to Cortes Island.

- Millennials and Gen-Zers, people whose potential to be powerful actors for social change and community well-being, are being stymied by runaway student debt.

- Gen-Xers and Baby Boomers and others with financial capital looking for safe, local investment opportunities.

You may want to focus on a neighborhood or city, a support group, or other constituency.

Activate your core volunteers

Staying committed, organized, and building your collective capacity to get a new organization started takes time. It requires relationships built on trust, a shared understanding of our unjust economic system, and a capacity to make shared decisions and work out conflicts quickly.

As a cooperative, everyone in the organization has a say, but ultimately it’s critical to build a core group of volunteers for the organization. SSCoFi was able to build this trust and collaboration within our core organizing team through biweekly evening meetings.

Create space for sharing stories and identify your community’s needs

A key part of forming our community was a series of intergenerational conversations across the Salish Sea to collect stories and testimonies about people’s experiences with student debt.

People lived in stress and anxiety over calls from lenders but rarely spoke about the debt to family and friends. It provoked shame. Many hadn’t even tried to refinance or deal with growing interest rates on debts that had gone “delinquent” because of how inaccessible help seemed and how anonymous they felt. Hearing these stories shared out loud was powerful and reaffirmed the key organizers’ belief that a collective solution was needed to address this debt crisis.

From these testimonies, three primary needs emerged:

- The need to alleviate the financial and psychological burden of high-interest student debt among Millennials and Gen-Zers in our community;

- The need for values-aligned investment opportunities for individuals and especially baby boomers with capital; and

- The need for more financial-empowerment training, education, and mentorship on issues that connect personal financial empowerment to collective systemic change to address equity.

These became the guiding lights for how we have addressed many questions about how to organize, operate, and run SSCoFi.

Define your community’s privilege and position

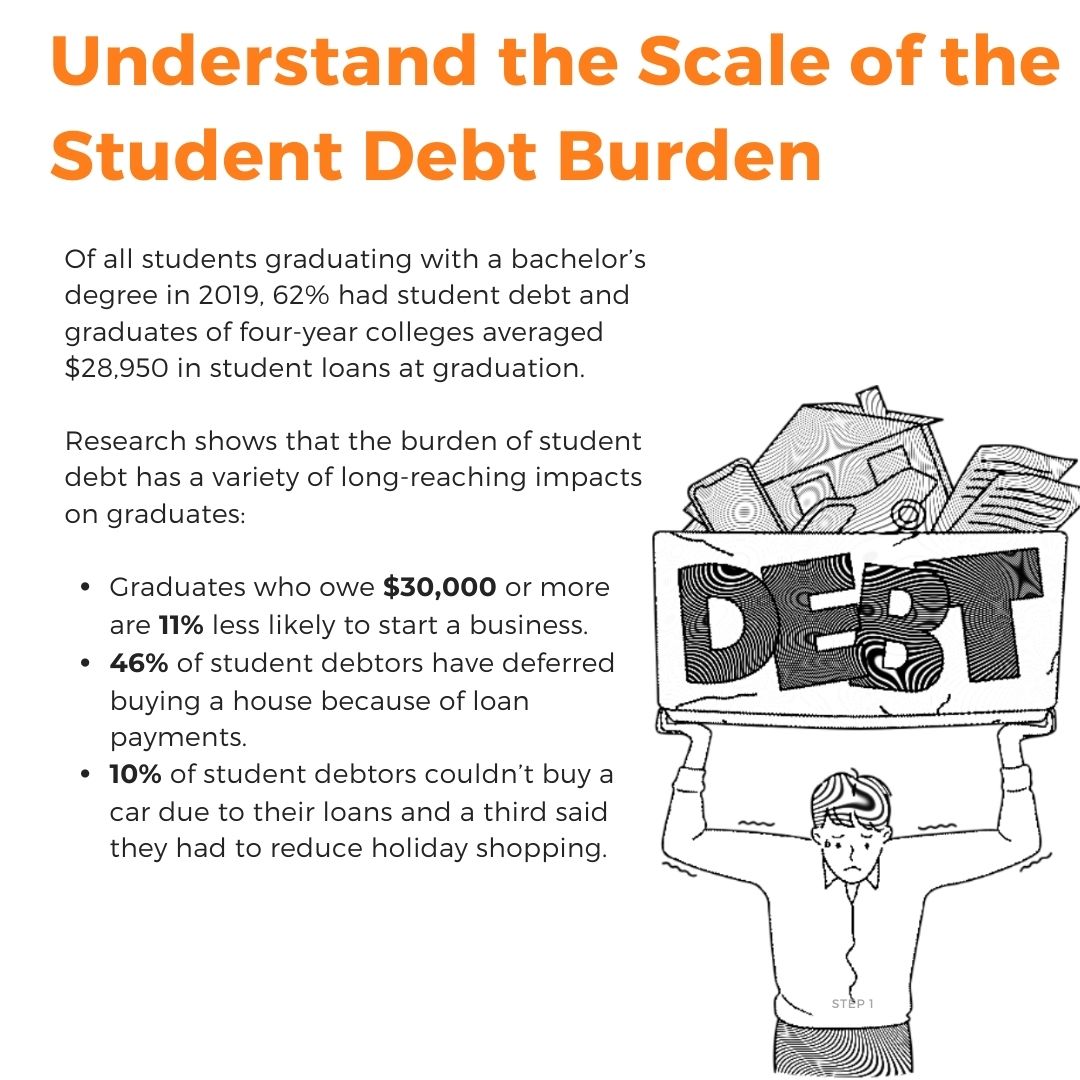

Student debt is an issue that, like most forms of debt, disproportionately impacts individuals of color. In 2018, 78% of black students borrowed federal student loans for school, compared to only 57% of white students. Half of these black students defaulted at some point during their student loan repayment process, compared to 22% of white students. Recognizing that generations of white supremacy and racial oppression against people of color are the underlying reasons for this disparity must inform all work to address economic injustice.

SSCoFi has worked to educate our membership about this history and to take it into account when deciding which loans we refinance and in what order. We chose to tackle student debt because it is a widespread issue (after mortgages, it is the second-largest category of debt owned by American consumers) and one that all of the initial project organizers had direct ties to. It’s also a form of debt that felt particularly generationally defined and one that tackling had substantial long-term systemic benefits in addressing.

2. GOVERNANCE & CULTURE

Once you’ve gathered, you have to figure out how to govern. The governance decisions discussed here assume that you are also constructing a cooperative structure, not a corporate or nonprofit one.

While a 501(c)3 could have offered us certain benefits, such as access to more grant opportunities and the ability to accept donations, we chose a cooperative structure. For us, it was about embodying values of cooperativism, bringing together all stakeholders under one “roof,” sharing profits with our members, and so we could have member engagement at the level of voting on different resolutions, changes to the bylaws, etc.

Co-op governance is built around the core Cooperative Principles and structurally relies on by-laws, membership structure, and a cooperative culture.

Debt Cooperative By-laws

By-laws are the written framework for how your organization works. They are required for cooperative registration and codify how decisions are made and even the organization’s lifespan (if you choose to specify). There are many great resources on by-laws, but we recommend starting with the International Cooperative Association (ICA) bylaw template.

Your membership is the bedrock of your organization. For us, members are Washington-state residents who have chosen to engage with debt inequality in their community through refinancing their own loans or assisting others to do so. They are active at quarterly member meetings and vote on by-law changes and new board members. They are engaged with their own and their community’s financial empowerment, health, and social justice.

In addition to our member-owners, we have a working board of eight individuals meeting biweekly to handle the day-to-day running of the business, such as accounting and event planning, and prepare big questions for the broad member meetings. Not everyone needs to know how to do everything—but it’s helpful that everyone knows who can do what. Regular meetings ensure that decision-making remains clear and that relationships stay strong.

Culture

As a volunteer-run cooperative, one thing to prepare for is the ever-shifting capacity of active volunteers. People are giving their time and labor to a collective effort and likely for free. This means that your organization needs to be able to move with the flow of capacity of the individuals doing the work and honor that people’s lives will change. It also means that, as an organization, you need to consider what the cooperative is giving back to its members to sustain them and make them feel excited to be there.

Two big things we have done for culture building over the last few years:

Peer mentorship

Peer mentorship was baked into many of our early conversations in the cooperative. Different members would be able to support each other on their career and financial paths in unique ways. This has happened formally and informally.

Co-working parties and “check-in” culture

Managing SSCoFi has happened in a culture of co-working. Co-working creates accountability for the work at hand, reaching beyond the boundaries of just the work of the co-op. It’s a way of creating spaces for solidarity and support that transcends the “productivity mindset.” In meetings, we begin with check-ins, where people can share how they are doing, emotionally or personally, before the work begins.

3. LEGAL

In addition to bylaws, membership, and culture building, you’ll have to legally formalize your organization and its structure. It is an important and often intimidating step in deciding on the exact model you want to create. Your chosen business structure ends up creating certain constraints (or lack thereof) on growth, protocols for meetings, operations, etc.

There are two main legal requirements for a community-lending model: incorporation and lending regulation. While our own example is laid out in the guidebook, this is definitely somewhere you’ll want to make sure you’ve looked at both state and federal laws that may apply to your organization (especially on local lending regulations, which may be more obscure than incorporation).

At SSCoFi, we are formally incorporated as a federal C-Corp and a Washington state nonprofit cooperative. On the second question of lending regulation, we worked with a local nonprofit law firm that analyzed local laws and provided written guidance that our model does not require lending or securities regulation. For both questions, we recommend you work with local experts to determine the right form of incorporation, any requirements for local lending, and any other local legal requirements.

4. FINANCIALS & ACCOUNTING

While Wall Street works to make lending and finance seem like a dark art, it’s actually much more straightforward than they would have you believe. The number one rule is that there is no perfect solution to the question of how to structure your lending and finances. The decision of how to set up the details of the loans depends on the needs of the borrowers, the investors, and the overall member community.

While your particular solution will be unique to your community’s situation and resources, the key questions and factors to consider when trying to create a financially sustainable community lending model will be the same. First, how much will your borrowers have to pay, and how long will they have to pay you back? Second, where will you get your lending money, and what will you have to pay investors? Third, how much (if anything) will it cost to run the organization? Our guidebook provides our solution, but don’t be afraid to iterate and experiment to find what works for your community.

You’ll also need to make sure you are properly accounting for all your loans and financial transactions. While it’s natural for folks to shy away from accounting as too dry, it is essential to maintaining the trust of your community and keeping the organization moving forward in a responsible and transparent way.

Broadly speaking, your top priorities should be opening a bank account for your organization, setting up software to track accounts, and managing how to file your taxes each year. We recommend going with a local bank or credit union to make sure you are keeping money local. For software, many use Intuit Quickbooks, but we use an open-source accounting software called GnuCash. While simpler than Quickbooks, it is more than enough for our organization and a better fit than something with more bells and whistles. Finally, we have members with enough accounting experience to file our taxes, but we did have a local social justice-oriented accounting firm complete our first tax filing so we could learn from them and have the first year as guidance for the future.

5. LENDING PROCESS

Finally comes the actual lending. It took us about two years to get to this point, so give yourself a nice pat on the back for reading this far!

Our loan process came from a combination of member experience in the lending industry and documents we received through collaboration with a local nonprofit lender. While it can be tempting to try and create an elaborate process to cover every data point and possibility, we highly recommend keeping the process of collecting information and evaluating potential borrowers as simple as possible—and even the best attempts to keep a process simple can create inequalities by adding barriers for folks.

Getting comfortable with this isn’t easy. It can feel very intimidating, and some of the most empowering moments of our work has been collectively tackling these issues and getting comfortable with debt. While most lenders keep their details locked away, we believe that greater shared understanding is critical for shared success, so we’ve included templates for all of these in our guidebook here.

In conclusion

Debt is a psychological weight that shifts the imagination from thoughts of possibility and empowerment to thoughts of crisis and necessity. Our modern capitalist system is meant to perpetuate those thoughts and push individuals to think of themselves first above all else. After almost a half-decade of work, the team at SSCoFi has sought to challenge the underpinnings of this framework and instead begin to imagine a different world: one where communities of mutual support lift each other up.

We started as a group of organizers around shared plates at potlucks, wondering how we could do something, anything, to help tackle the student debt crisis all around us. Along the way, we also became friends who supported each other through challenging life changes that expanded far beyond the reach of the student debt crisis.

Our lending, and this guidebook, are the result of pushing through more false starts and dead-ends than we can remember. It hasn’t been easy—but it has been humane, which is to say, human-scale and relationship-centered. We taught each other and sought help from experts for the big stuff.

If a bunch of randos meeting around a plate of tater tots every other week can figure out how to make this work, you can too.

Comments

Howard Switzer

July 17, 2023, 2:15 pm

"Debt is a psychological weight that shifts the imagination from thoughts of possibility and empowerment to thoughts of crisis and necessity." Brilliant perception. Yes, this is true and the problem is that all money is created as debt when it does not have to be. It is a 300 year old banking scam called usury, "the abuse of monetary authority for personal gain." Dante called it "an extraordinarily efficient form of violence by which one does the most damage with the least effort."

Eighty-Four years ago, in the face the Great Depression caused by a wide range of abusive practices by the Fed banks, the world's communities of 'Economists' considered the proposal of Dr. Irving Fisher, Dr. Paul Douglas and several other eminent economists. It was inspired by the work of Frederick Soddy, the father of Ecological Economics, to reform the money system along the lines we now propose. The proposal was supported by some 400 economists, world-around, to restructure our money system from one of private issue and gain to that of public issue and public gain.

This is what Greening the Dollar, the monetary platform of the Green Party proposes. Greens are the only party calling for this reform. Not since the progressive populist era has a political party called for a public money system. Greens should be proud and loud about this because it is the answer to “How are you going to pay for it?” This transformative proposal must become the cornerstone of any effort for ecological and economic balance because the privately controlled profit-motivated monetary system is the primary roadblock to good public policy, foreign and domestic.

In just the 5 years from 2009 to 2014 the 200 most politically active companies in the U.S. spent $5.8 billion influencing our government with lobbying and campaign contributions. Those same companies got $4.4 trillion in taxpayer support – earning a return 758 times their investment. Imagine what those figures look like today! There can be no question as to why public policy does not serve the public interest as that same study concluded that ordinary citizens have zero influence on public policy.

It is rarely reported, but Wall Street banks also own controlling interest in all the major corporations, have representatives on their boards of directors, issue loans to these corporations, and have great influence over the behavior of these corporations. This power and influence is derived from the banks' privilege of creating deposits and issuing loans, for what we all use for money.

Greening the Dollar proposes three simultaneous reforms to change this permanently:

1. Require Congress to be the sole creator of all U.S. money debt-free;

2. End the privilege of commercial banks to create money.

3. Transfer all remaining operations of the Fed to the U.S. Treasury.

The legislation to do this is already written and vetted for 3 years by the office of legislative council. It was introduced in 2011 as the NEED Act. We just need a poor and working people's movement to elect a Congress dedicated to the public interest who will pass these reforms and fulfill, at last, its Constitutional mandate.

This is not a partisan issue; it is the issue of the 99.9%

• It ends the systematic concentration of wealth to the wealthiest

• It stabilizes the economy by eliminating the boom/bust cycle, a steady state economy.

• It sets the economy onto an income basis instead of a debt basis.

• It would empower Congress to serve the people, making money political again.

Because money controls public policy, money should be a public function not a private for-profit privilege.

Please contact me for more information. Hold the line, up our game, in solidarity.

Howard Switzer

July 17, 2023, 2:37 pm

Indeed, refinancing is one way to deal with debt, debt to pay debt, but as you noted, it does have psychological consequences. Local currencies have not been effective because they've been limited to networks requiring maintenance. However, if a local government issued currency for labor and materials to do public works with which one could pay their local taxes they could be very effective. Further, if there was a parking fee (demurrage) attached to the currency to discourage hoarding, making it a pure exchange medium, a lot can be accomplished fast due to the high velocity of circulation. The was demonstrated in Wörgl, Austria in the depths of the great depression in 1931-32 where $2.5 million in public works were accomplished in 15 months by issuing only $6000. People saw the benefits coming back to them so fast they began paying their local taxes in advance. It was called the Miracle of Wörgl and hundreds of towns world-around sought to duplicate it but were all shutdown by the central banks of the global banking system. Can we force the issue today? People need to be informed about money and how the system works to benefit the few and how it could work to benefit the many. Please contact me if interested in working with us. monetaryalliance.org

Add new comment